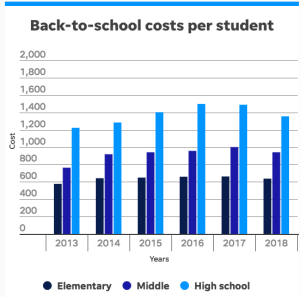

Some high school students and their families are struggling with the rising costs of school supplies, extracurricular activities, and standardized test fees. What was once considered a free education is now becoming a costly endeavor for many households.

While public school tuition remains free, other costs continue to skyrocket. According to a newly published article by Empower, “Manufacturing costs of key back-to-school items have increased an average of 24% in the past 5 years.” This has translated to in-store price increases. Many parents have had to cut back on after school programs or even purchase cheaper secondhand items to stay within their budgets.

Meet Dana Dominguez Polo, a current freshman at the iSchool, who quickly realized just how expensive high school can be. She states, “At the start of the year, I figured I would splurge on lunch every day, but now that it’s been a couple of months, I truly wish I had saved that money.” Like many students, Dana didn’t anticipate how quickly small daily expenses would add up, making her think about her everyday spending habits.

Dana’s experience isn’t unique. Many students experience financial hardship not only from large spending, but also from the gradual accumulation of smaller fees.

Despite the financial hurdles, many students find creative ways to make it work. “I’ve learned to stop chasing after every new trend and instead focus on saving for what’s important,” freshman Michelle Leon Ramos said. “It’s just about finding alternatives that fit your budget.”

While many find ways to manage on their own, others look for support through school programs. The iSchool offers resources like free MetroCards and lunch, but not all students know these options exist.

According to NYC Public Schools, “New York City Public Schools offers free breakfast, lunch, and afterschool meals to all NYC public school students during the school year.”

Furthermore, research from InsideSchools indicates, “New York City offers children and teens a wide range of after-school and summer activities, both free and paid.” The government supports students in many ways in order to alleviate the stress of budgeting.

Additionally, opportunities like college applications, SAT/ACT testing, and Advanced Placement (AP) exams pose extra costs. For instance, it costs $68 to take the SAT, while each AP test runs over $90. According to Coursera, the average student takes the SAT twice, and one AP class throughout their high school journey, adding up to roughly $160. Although fee waivers exist, they are not always well advertised, leaving some students who may be in need to miss out on financial assistance.

A survey conducted by EducationWeek found that “43 percent of students who self-report their family income as under $30,000 do not use a fee waiver.” This finding shows a significant lack of awareness regarding these financial aids among students. Many students feel discouraged from taking AP tests, the SAT/ACT, and applying to colleges. “It’s not just about the money — it’s about feeling like you’re missing out on memories everyone else is making,” says freshman Autumn D. “You don’t want to be the only one sitting out because you can’t afford it, so try and save your money.”

Beyond academic costs, social events have a price as well. Many school-sponsored events—field trips, dances, and fundraisers—require students to pay to participate. Though these activities are not required, they are a central part of the high school experience. Not partaking in them might cause kids to feel left out.

Some high schools are helping with small-scale financial aid programs for students who are unable to work. Fundraising programs, used book sales, and donation drives, can help students acquire resources at lower costs. But these initiatives may not always be enough to fully address students’ financial hardships.

The growing expenses of high school can have long-term effects on students’ futures beyond their current impact.

A growing problem is that financial difficulties can restrict a student’s ability to engage in school. According to the European Sociological Review, “Research across countries shows that children from lower-income families are less likely to participate in extracurricular activities than children from more affluent families.” Students who cannot afford extracurricular activities, trips, or test fees sometimes miss out on chances that can improve their college applications or help them discover new interests.

Students’ mental health can also suffer from the need to manage finances, jobs, and education at a young age. Such tasks can potentially cause stress, loneliness, and even shame.

These financial difficulties impact not only what students can afford but also their level of school inclusion. The more students are aware of resources like fee waivers or donation programs, the more progress schools can make toward creating an environment where every student feels like they belong, no matter their financial situation.

Many students feel embarrassed to share financial problems. Instead of asking for help, they might choose to miss out on activities to avoid feeling embarrassed. This judgment only makes things worse; it creates a loop by which money issues cause mental health problems, which then affect academic performance.

According to the Urban Institute, almost one in four students eligible for free or reduced-price lunch do not take advantage of the program. Many of them steer clear of it because they worry about classmates labeling or judging them for their socioeconomic status.

Schools should reduce the judgment around financial difficulties in addition to providing financial aid. Open conversations, student-led projects, and raising awareness of financial difficulties could help build a more inclusive environment in which no student feels embarrassed to seek help.

High school students should be free to focus on their studies, personal development, and career readiness. For many, the growing expenses of education are making complete participation more difficult. The costs of extracurricular activities, school supplies, and standardized tests are putting a growing financial strain on families and students.

Although some students learn to budget, work part-time, or apply for financial help, these fixes rarely solve the underlying cause of the problem. Though many options are available, they are sometimes underused because of ignorance or shame around financial hardships. Students thus find themselves lonely, stressed, or forced to make difficult decisions on what they can and cannot participate in.

Communities and businesses, as well as schools, have influence. They can help students by lowering the judgment around money problems, enhancing communication about accessible services, and boosting access to financial aid. Money should not prevent someone from having learning opportunities.

High school should ultimately serve to prepare kids for the future rather than creating more obstacles. Increasing the accessibility and affordability of education guarantees that every student, from all financial backgrounds, has a chance at success.