For many high school students, income often revolves around part-time jobs, gifted money, or even allowances. While saving has long been the go-to option for young people, could investing be an even smarter strategy?

Saving is the process of setting aside money for future expenses, usually the near future. Your saved money should be kept in a safe and accessible place, like a piggy bank or savings account. The main goal of saving money is to have the ability to access it when you need it, whether that’s for an emergency, a big purchase, or any other reason.

Investing is the process of buying assets–like real estate, bonds, or stocks–with the goal of growing your wealth over time. Unlike saving, investing has risks because the value of investments can go up or down.

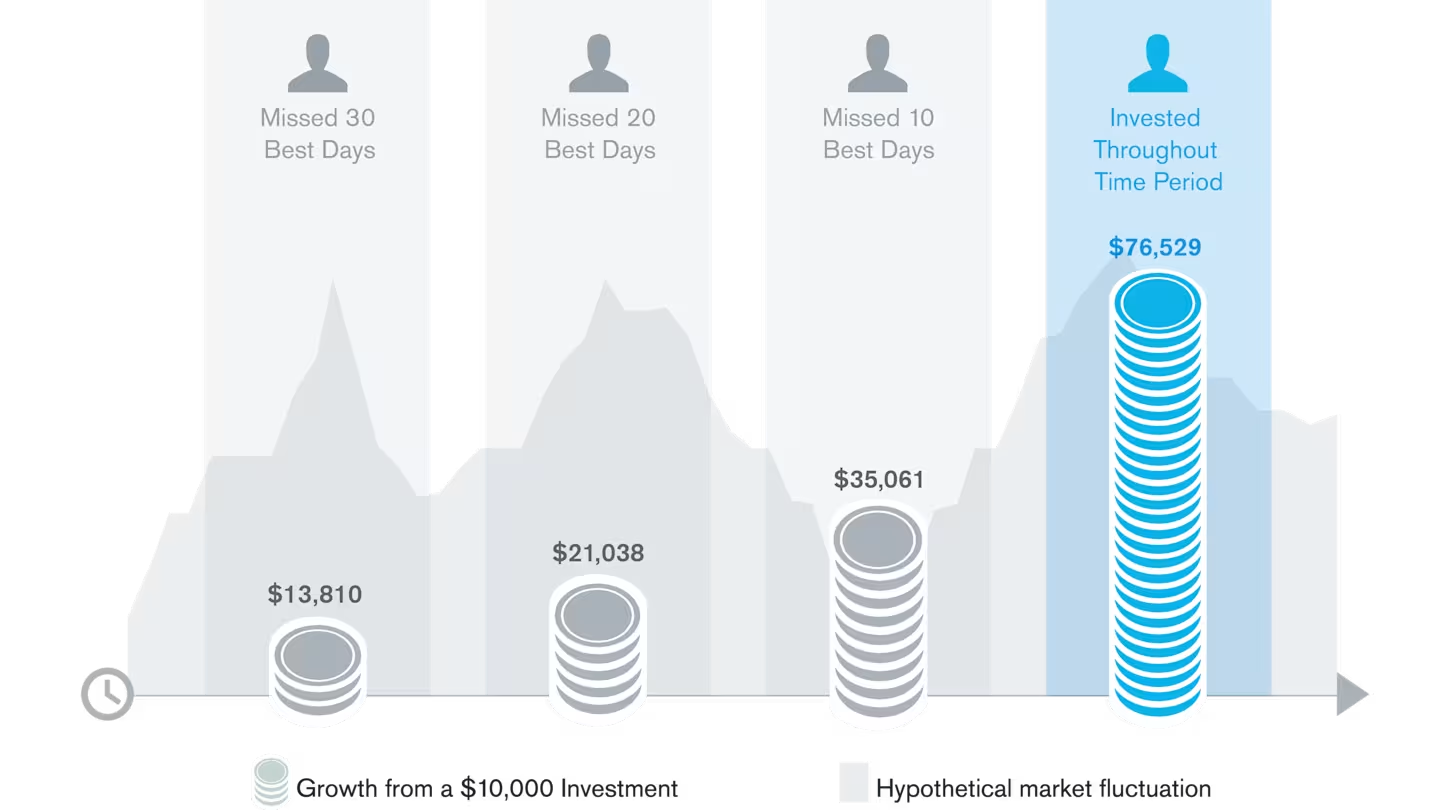

The key to investing is patience, as it can take time for investments to grow. It’s a strategy that focuses on increasing wealth over time, not instantly.

The key to saving money is consistency; you need to make it a routine. A memorable quote by CNBC states, “At the end of the day, the goal is to just make sure you’re saving some portion of your paycheck — even just $20. By saving up a little each time you get paid, you’ll make saving a habit and it’ll soon become second nature to you.”

There are many factors that come with investing and saving, “Knowing if you’re ready to start seriously saving or investing also has an emotional aspect to it, which is just as important as understanding the financial side of things,” says iSchool economics teacher Ms. Turso.

Saving requires discipline and patience–you have to be comfortable with setting money aside and resisting the urge to spend it impulsively.

However, investing involves risk and unpredictability. “If you’re prone to making decisions based on emotions – like buying during market highs out of fear of missing out or selling during downturns due to panic – you may need to reconsider your approach. Emotional investing often leads to poor timing and missed opportunities, which can significantly impact your returns,” said SmartAsset.

If you feel confident in your ability to stay calm, think long-term, and not make emotional decisions with your money, you might be ready. If not, that’s okay–building financial confidence is a process, and starting with smaller steps can help you get there.

Below are some tips and examples of saving and investing:

QUICK SAVING TIPS:

- Decide what you need and how much it is. When you have a target goal it helps you stay focused and motivated.

- Paying yourself first is an easy way to make saving a daily habit. When you get money, immediately set aside a portion before spending any of it. It builds the habit of saving consistently and prevents you from over spending.

- Avoid impulse purchases. Before buying anything, wait a minimum of 24 hours to see if you really need it. Many purchases might seem urgent although they aren’t. This can prevent wasteful spending and keep more money in your pocket.

TYPES OF SAVING ACCOUNT:

- Traditional savings account: Typically open alongside a checking account, a traditional savings account offers a low interest-rate with the perk of depositing and withdrawing money multiple times a month. It’s a safe place to store money with easy access through ATMs, branches, and online banking.

- High-yield savings account: Offers a significantly high interest rate rather than traditional savings accounts. While they provide easy access to funds, transfers may take a couple of days since they don’t usually offer ATM access.

- Money market account: They have higher interest rates than checking and savings accounts, you can only make a limited amount of withdrawals monthly. If you don’t need your money for a while (e.g., 6 months, 1 year, and more) it might be your ideal choice.

- Certificate of deposit (CD): A CD pays more interest the longer it holds your money. They usually require a minimum deposit ($500 – $1,000) while not allowing you to withdraw money for around 6 months to 5 years. If you retract your money early you could be charged a penalty fee.

QUICK INVESTING TIPS:

- Starting early is a big part of investing, the earlier you start, the more time your money has to grow. Even small investments can significantly grow over time with compound interest.

- Invest in a wide variety of products to reap all the benefits and reduce the risk of losing all your contributions on one product that underperformed.

- Before investing in any stock or asset, take time to understand the company or investment. Researching can help you make informed decisions and avoid any unnecessary risks.

TYPES OF INVESTING ACCOUNTS:

- Bonds: A type of loan you are making to the government or a company. They tend to have low rates of return since they are safe. Every month you will be paid your earned interest, then return the original amount at which the bond was purchased at the end of the bond’s term.

- Mutual funds: A pool of investment products combined into one account. While they usually have different rates of return, it’s very uncommon for this type of fund to lose any money.

- Real estate investment account: This type of investment account allows investors to put money into real estate properties or real estate-related assets. This can be done directly by purchasing physical properties or indirectly through real estate investment trusts (REITs), which are companies that own or finance real estate.

While these types of accounts all serve a purpose, you typically need to be between the ages of 18 and 21 to open them. However, if you believe you’re ready to start today, a custodial account may be the solution. This allows a parent or guardian to manage your savings and/or investments. Once you reach the required age, you inherit the account, and all the earnings legally become yours.

Whether you choose to save, invest, or do a mix of both, the most important thing is to start building good financial habits now. Saving helps you prepare for short-term needs and unexpected expenses, while investing allows your money to grow over time.

“When students get money, they should set aside a certain percentage for saving and keep some for personal use,” said Ms. Turso. Understanding your financial goals, emotional readiness, and risk tolerance will help decide the best approach for you.

No matter where you start, the key is consistency. Even small steps, like setting aside a few dollars each week, can make a big difference over time. By taking control of your finances early, you’re setting yourself up for a secure and prosperous future.